MLB’s Antitrust Exemption

THE BOX SCORE

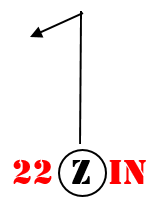

Baseball’s antitrust exemption allows it to act as a monopoly. This means that MLB can:

Depress players’ salaries through the reserve clause (1887 to 1975).

Have a draft.

Impose a luxury tax.

Pay minor leaguers a pittance.

Eliminate minor league teams.

Control the location and movement of franchises.

Say who can own a team.

Package television contracts, share revenue, and blackout games.

Control merchandise.

Prevent the formation of rival leagues.

THE COMPLETE GAME

In Curt Flood, the Supreme Court, and MLB’s Antitrust Exemption, we saw how a trio of Supreme Court cases—Federal Baseball (1922), Toolson (1953), and Flood (1972)—exempt baseball from the provisions of the Sherman and Clayton Antitrust Acts. This allows MLB to act as a monopoly and do things that would be illegal in most other industries. But what are those “things”?

Baseball’s antitrust exemption allows:

The Reserve Clause (1887-1975)

In 1887, professional baseball formalized the longstanding practice of adding a “reserve clause” to players’ contracts. Once a ballplayer signed with a team, the reserve clause bound him to that team for the rest of his career. The team could cut or trade the player at will, but the player had no say in the matter.

There were many consequences of the reserve clause, one of which is that it severely depressed players’ salaries. Players could not sell their talents to the highest bidder, so they had to accept whatever paltry salary the owners offered, which was far under market value. In the reserve clause era, owners truly owned their players.

The reserve clause ended in 1975 when an independent arbiter ruled that baseball players Andy Messersmith and Dave McNally could file for free agency.

The Luxury Tax

Baseball is the only U.S. professional sport without a salary cap. However, MLB imposes a luxury tax on its big spending teams. In 2023, the limit was $233 million, and the following teams were taxed:

Mets -$100.8 million

Padres-$39.7 million

Yankees-$32.4 million

Dodgers-$19.4 million

Phillies-$7 million

Blue Jays - $5.5 million

Braves - $3.2 million

Salary caps, and to a lesser degree, the luxury tax, are economically anti-competitive practices. Imagine if all tech companies—e.g., Google, Apple, Microsoft, etc.—got together and said, “We’re not going to pay our workers more than $75,000.” That is collusion, and it is illegal.

Salary caps are legal in sports for two reasons. (1) Most sports have a players’ unions, and unions are covered under the National Labor Relation Act and not by antitrust law. That means owners and players negotiate collective bargaining agreements, which can include salary caps. Players must first decertify the union if they want to file an antitrust case, as the NFLPA did in 2011. (2) Salary caps arguably preserve a competitive balance in the league, so they are generally allowed under the “rule of reason” (see below).

The Draft

Unless you’re a top pick or were drafted by the Oakland Athletics, you probably haven’t spent much time thinking about how unfair sports drafts are. But from a players’ perspective, drafts are an anti-competitive labor practice. Players have no say in who drafts them, and top draft choices must sign for less than they would if there was a bidding war for their services. The MLB’s draft slot value, instituted in 2012, further depresses what rookies can make by setting upper limits for signing bonuses. If a player doesn’t like the team that drafted him or doesn’t like his signing bonus, the only option is to wait until next year’s draft.

Minor League Contracts

Minor League Baseball (MiLB) is currently one of the battlegrounds in the fight over baseball’s antitrust exemption, and there are a couple of fronts. The first is minor league contracts. The Curt Flood Act of 1998 modified MLB’s antitrust exemption concerning labor, but specifically exempted minor leaguers. And until recently, MiLB was not part of MLB’s collective bargaining agreement. As a result, many players lived well below the poverty level.

In 2014, several minor league players filed a class-action lawsuit, Senne et al. v. Office of the Commissioner of Baseball, et al., demanding that owners pay them as hourly employees subject to minimum wage laws, including overtime.

In response to the pending lawsuit, U.S. Representative Brett Guthrie (R-KY) introduced his Save America’s Pastime Act of 2016, which would have exempted minor league players from minimum wage laws. Although Guthrie’s bill never made it out of committee, it was tacked on as a rider in the must-pass Consolidated Appropriations Act of 2018 in the next Congress. Buried deep in the 1,200-page spending bill was this little gem:

“[A]ny employee employed to play baseball who is compensated pursuant to a contract that provides for a weekly salary for services performed during the league’s championship season (but not on spring training or the off season) at a rate that is not less than a weekly salary equal to the minimum wage under section 6(a) for a workweek of 40 hours, irrespective of the number of hours the employee devotes to baseball related activities.”

As anyone who has played minor league ball knows, the typical work week is way beyond 40 hours. So, the spending bill ensured that minor league teams would not have to pay their players a living wage.

After COVID-19 canceled the 2020 season, things started looking up for minor leaguers. In 2021, MLB increased minor league salaries between 38 and 72 percent. In 2022, MLB settled the lawsuit with minor leaguers who played in the California League for $185 million. And, for the first time, MLB’s 2023 collective bargaining agreement covered minor league players, resulting in a dramatic increase in minimum salaries:

Complex league: $4,800 to $19,800

Low-A: $11,000 to $26,200

High-A: $11,000 to $27,300

AA: $13,800 to $27,300

AAA: $17,500 to $45,800

Minor League Teams

In September 2020, MLB eliminated 40 minor league teams and took over MiLB from the National Association of Professional Baseball Leagues, which had run the minors since 1901. Three contracted teams—the State Island Yankees, Tri-City ValleyCats, and the Salem-Keizer Volcanoes—sued, alleging that baseball had violated the Sherman Antitrust Act.

The U.S. District Court of Manhattan dismissed the suit, arguing the Federal, Toolson, and Flood cases had long since settled the matter of baseball’s antitrust exemption. After the 2nd U.S. Circuit Court of Appeals affirmed, the petitioners appealed to the Supreme Court. Rather than face another Supreme Court, MLB settled for an undisclosed sum.

There was good reason for MLB not to want the case to go to the Supreme Court. In 2021, the Supreme Court unanimously ruled that the NCAA’s amateur requirements violated antitrust law. For MLB, it probably was not encouraging that none of the justices upheld the NCAA’s request for antitrust immunity. It was even less encouraging that Justice Neil Gorsuch, writing the Opinion of the Court, chose to note that the Court has “acknowledged criticism of the [Federal Baseball] decision as ‘unrealistic,’ and ‘inconsistent,’ and ‘aberation[al]’” And it was less encouraging still that, as a District Judge, Gorsuch wrote that even though the Court had “long since rejected the reasoning [of the Federal Baseball decision], the Supreme Court has still chosen to retain the holding itself, only out of respect for the reliance interests.” All of these signs suggest that MLB’s win streak at the Supreme Court might soon be coming to an end.

Franchises

If you are the CEO of a regular business and want to move your headquarters from San Jose to Houston, you just do it. Not so with sports leagues.

All U.S. professional sports leagues have some exemption from antitrust laws that permit them to control team location and movement. However, this exemption is not absolute. The courts have found that sports leagues have a compelling interest in keeping teams in specific markets, preserving territorial boundaries, and ensuring economic viability. The standard that courts use to determine whether a league can block a franchise move is the “rule of reason.” If the league gives a good reason why a team should stay, then they stay. If there isn’t a good reason, then they move, as the Raiders and Clippers did in 1984.

Unlike the NFL and the NBA, MLB has never faced a successful legal challenge resulting in a franchise move, although there were a few close calls. In a 2022 congressional hearing, MLB Commission Rob Manfred pointed to the antitrust exemption as the reason why only one team—the Montreal Expos—has relocated since 1972:

“In that same period [1972-2005], 14 NBA, 10 NFL and nine NHL franchises have relocated. MLB differs from other professional sports leagues because MLB’s antitrust exemption allows it to enforce a rigorous process that ensures club relocation is carefully considered and vetted.”

In addition, the MLB’s antitrust exemption (arguably) allows it to contract teams, as then-Commissioner Bud Selig threatened to do in 2001 and as MLB did to 40 minor league teams in 2020.

Ownership

If you want to sell sneakers, all you need is a business license and a couple hundred million to compete with Nike and Reebok, and there is nothing the big brands can do to stop you (at least not in court). Not so with baseball.

MLB controls the number of franchises and who owns a team. Just because you’re worth a couple of billion and have the highest bid does not mean you own the Red Sox, as Charles Dolan and Miles Prentice learned in 2002. MLB has specific rules that say players can’t be owners, nor can municipal governments, as McDonald’s heiress Joan Kroc found out when she tried to give the Padres to San Diego.

Broadcasts and Revenue Sharing

MLB’s antitrust exemption allows it to package broadcasting rights. In a competitive market, each team would negotiate its own television deal. But while teams compete with each other on the field, they collude when negotiating television contracts. By “pooling” its teams, MLB can land far more lucrative deals than if each team signed its own contract. The current national broadcast contracts include:

Fox: $5.1 billion for ten years

Turner Sports: $3.2 billion for seven years.

ESPN: $3.9 billion for seven years.

MLB then gives teams an equal cut of the national television money, which guarantees each team $60.1 million annually. Revenue sharing might be a good practice, but it too is anti-competitive. After all, the Yankees and Athletics get the same share despite the fact the As are rarely on national television, and when they are, no one watches.

MLB teams can also sign deals with regional networks. For instance, Bally Sports Networks will cover 11 teams on their regional channels in 2024 despite the recent bankruptcy of its parent company. Teams make an estimated minimum of $40 million from these regional deals on top of their share of the national contracts. The most popular teams—the Yankees, Cubs, Mets, and Red Sox—even have their own networks, which are extremely lucrative. The Yankees’ YES Network alone brought in $143 million in 2022. As Craig Goldstein, the Editor-in-Chief of Baseball Prospectus, writes, “…every single team is getting $100m + before selling a ticket.”

MLB’s antitrust exemption also allows it to blackout games. Blackouts are especially maddening for those who paid $150 for MLB.TV, only to discover they can’t watch a home team’s games because of some regional network contract.

MLB is not unique regarding broadcasts and antitrust. The Sports Broadcasting Act of 1961 allows all professional sports leagues to negotiate package deals and blackout games.

Merchandise

MLB’s antitrust exemption allows it to pool merchandising contracts just as it pools television contracts. However, MLB now faces a suit alleging its Fanatics deal violates antitrust law.

Discourage Rival Leagues

MLB’s antitrust exemption allows it to do all sorts of things to prevent the formation of a rival league. MLB could prevent stadiums and threaten television networks if they hosted or aired the rival leagues’ games. As economics professor and baseball historian Michael Haupert writes,

“The National Football League provides an example of what kind of competition baseball may have faced had the Supreme Court ruled differently in any one of its three baseball cases. Since 1922, the NFL has had to face off against no fewer than 14 competing leagues.4 In 1986, the United States Football League even successfully sued the NFL for monopolistic practices. MLB’s antitrust exemption has made it virtually impossible for another league to compete. There has been no serious attempt since the demise of the Federal League in 1915.”

Conclusion

There is a big debate about what would happen if baseball lost its antitrust exemption, which I’ll discuss in the next article. Some things might change, but a lot would remain the same.

The loss of the antitrust exemption would certainly weaken the Commissioner’s office. It might mean more team relocation, more competition in merchandising, and an uncertain future for the minor leagues. Losing the antitrust exemption would also cost the U.S. government its main leverage over Major League Baseball (see A Useful Threat).

Yet, things probably wouldn’t be that different. Baseball could still pool teams for television contracts and blackout games by virtue of the Sports Broadcasting Act of 1961. Labor issues would still be governed by collective bargaining agreements. Moreover, all sports leagues have a modified exemption from antitrust law that allows them to restrict team movement (within reason), hold a draft, and have a salary cap. In sum, the stakes surrounding baseball’s antitrust exemption are certainly lower now than when Curt Flood took his case to the Supreme Court in 1972.